Local Government Records Program

The Local Government Records Program (LGRP) provides advice and assistance to Ohio’s local governments concerning how to create and maintain sound records management programs while at the same time preserving those records that have historical value. The LGRP reviews retention schedules and disposal lists from local government, thus allowing the LGRP to select for preservation records that document governance and life in Ohio. We work with Ohio’s counties, municipalities, townships, school districts, libraries, courts, and other special taxing districts and the agencies and departments therein.

Ohio History Connection

State Archives Local Government Records Program 800 E. 17th Ave. Columbus, OH 43211 614.297.2553

Email UsStatement on Maintaining Digitally Imaged Records Permanently

The creation of reliable and authentic records is essential for the operation and accountability of Ohio governments. The Ohio Revised Code sets forth procedures for managing and providing access to public records. Computer technologies have revolutionized and enhanced the way that governments create, use, access, and store records. Increasingly, governments in Ohio are opting to scan their records and store those records as digital images.

Although Ohio History Connection, which administers the State Archives of Ohio, acknowledges the utility of maintaining digital images for access and retrieval purposes, it does not support the permanent maintenance of records solely in electronic image formats. Technological changes are rapid and constant. With no standards in existence for ensuring the long-term validity and survivability of digital images, it is nearly impossible to predict whether those imaged records will be retrievable in the future. Even well-implemented migration plans cannot assure that data will not be lost.

With this in mind, the State Archives strongly recommends maintaining an eye-readable backup of any records deemed of permanent value that have been digitally imaged for electronic storage. Eye-readable records are records that do not require the use of hardware and software to decode the information stored on them. Examples of eye-readable records include paper and microfilm. The American National Standards Institute (ANSI) issues a set of standards for the creation of microfilm that, if followed, ensure the survivability of microfilm for an estimated 500 years.

Public officials are responsible by law for ensuring that their records are protected and accessible for the time period stipulated in the record retention schedule. This responsibility applies regardless of the storage media on which records are recorded and maintained. With that responsibility comes the authority to decide in which medium to maintain their records. If an agency decides to retain records in electronic format permanently or for any long-term period, it is the agency's responsibility to ensure that these records remain reliable, authentic and continually accessible throughout the stated retention period.

It is not within our authority to approve or certify imaging systems, or to deny the destruction of paper records that have been reformatted to images. Our authority is derived from the Ohio Revised Code 149.31, which states that:

Ohio History Connection, in addition to its other functions, shall function as the state archives administration for the state and its political subdivisions.

It shall be the function of the state archives to preserve government archives, documents, and records of historical value, which may come into its possession from public or private sources…

The archives administration shall be headed by a trained archivist designated by Ohio History Connection, and shall make its services available to county, city, township, and school district records commissions upon request.

Within this provision, the State Archives offers advice and assistance on how to preserve records of enduring historical value that may one day come into its possession. Due to the unstable nature of electronic records over time, archivists must take precautions to ensure the survivability of electronic records at the time of their creation, not at the end of a record's life cycle.

Destruction of original materials should always be considered with extreme caution. Since electronic records and the technology surrounding them are in a continuous state of change, any record in an electronic format cannot be considered stable and capable of remaining reliable, authentic and accessible over any long-term or permanent retention period. Therefore, it is the recommendation of the State Archives that any digitally imaged records of permanent value also be maintained in either paper or microfilm format.

Organizational and Resource Links

Electronic Records Resources

Statement on Maintaining Digitally Imaged Records Permanently

Guidelines for Managing Email (OhioERC Document)

Social Media Tip-Sheet (OhioERC Document)

Digital Imaging Guidelines (OhioERC Document)

Guidelines for Managing Web Content (OhioERC Document)

Databases as Public Records Guidelines (OhioERC Document)

The State Archives, in conjunction with Ohio's Department of Administrative Services (DAS) Office of Policy and Planning (OPP), formed the Electronic Records Committee (ERC) to draft policy and guidelines for electronic records. Membership, drawn from policymakers, records managers, IT personnel, archivists, and librarians from various state agencies, universities, libraries and historical societies, is limited to 30-35 people who are committed to working towards solutions to electronic records issues.

Join the Ohio Local Government Records Management Listserv

- Do you have a records management/archives question?

- Do you think other local government entities would also benefit from knowing the answer to the question that you want to ask the State Archives Local Government Records Program?

- Does your local government have an innovative approach to solving a records management problem and you would like to share that approach?

- Would you like to receive email notices when the public records law has changed, when the LGRP website is updated, along with other announcements from the LGRP?

This is a public forum and discussion on the forum could be considered a public record. The Local Government Records Program serves as moderator and all members will be approved by the moderator before joining. This prevents possible spam. The moderator has the authority to ban members for spamming or posting inappropriate materials.

To request entry to join, please send us a message by visiting our Contact Us page and selecting "Local Government Records Program" from the drop-down menu. Please note that this group is available only to employees of local government entities.

Ohio Network of American History Research (ONAHR) Centers

As the archives administration for the state of Ohio, Ohio History Connection organized the Ohio Network of American History Research (ONAHR) Centers in 1970 to provide for the preservation of historically valuable local government records. Composed of four state universities and Ohio's two largest historical organizations, the network members preserve and make available all forms of documentation relating to Ohio's past.

Archival Services

Polsky Building

University of Akron

225 S. Main

Akron, OH 44325-1702

Archives and Rare Books Department

Blegen Library - 8th Floor

University of Cincinnati

Cincinnati, OH 45221-0113

Archives & Library

800 E. 17th Ave.

Columbus, OH 43211-2497

Library

10825 East Blvd.

Cleveland, OH 44106-1788

Archives/Library

151 W. Wood St.

PO Box 533

Youngstown, OH 44501-0533

Key Resources

Ohio History's Resources

Records Management Procedures (Where to Begin)- Orientation to the Local Government Records Program (LGRP)

Suggested Retention Periods and RC Forms- Suggested retention periods for records from local governments. Blank RC form templates for you to download and use, as well as instructions and examples.

Key Terms- A non-exhaustive list of common terms used in records management

Frequently Asked Questions- Answers to common records management questions

Training Opportunities- In-person workshops and online webinars

Join the Listserv- Connect with other local governments

Electronic Records Resources- Guidelines and best practices for managing electronic records

Disaster Preparedness & Response Resources- Basic precautions to help avoid disaster and links to useful resources

Ohio Network of American History Research Centers- Institutions charged with preserving Ohio's government records

County Archivists & Records Managers Association (CARMA)- Find out about county archives and records centers, meeting times and other CARMA information.

Local Government Records Manual

Overview of records management processes and procedures in a manual form to be a supplement to the suggested retention periods.

Records Management Key Terms

Access- The ability to consult, review, use or obtain records

Appraisal- The determination of the appropriate retention period of each record series, based on its administrative, legal, fiscal, and historical value

CARMA- The acronym for the County Archivists and Records Managers Association, an organization of archivists and records managers from Ohio’s 88 counties. The primary purpose of the association is to provide a forum for professional discussion and information sharing among county records professionals in Ohio. More information can be found here.

Certificate of Records Disposal (RC-3)- The RC-3 certificate serves as official notification of the proposed intent to dispose of or transfer records. Fifteen business days before disposal takes place, the originating office should send an RC-3 form to the Ohio History Connection’s Local Government Records Program (LGRP), if required, and a copy to their records commission. Templates for all of the forms can be found here.

Cutoff- The act of ending files at regular intervals, usually at the closing of a fiscal or calendar year, to permit their disposal or transfer incomplete blocks and to permit the establishment of new files.

Destruction- The disposal of documents of no further value by shredding, pulping, incineration, or deletion.

Disposal- Destruction or deletion of temporary records after their retention period expires

Disposition- The final state of the records lifecycle. At this point, the appropriate approved disposition instructions are applied which may be destruction or transfer of the records.

Electronic record- A record created, generated, sent, communicated, received, or stored by electronic means. See ORC 1306.01.

Inventory- A survey of records and non-record materials conducted primarily to develop records retention schedules and to identify various records management problems.

Lifecycle- The management concept that records pass through three stages: creation, maintenance and use, and disposition.

Non-record Materials- Material excluded from the legal definition of a record. If a document or other item does not meet all three parts of the definition of a “record,” then it is a non-record and is not subject to the Public Records Act or Ohio’s records retention requirements.

One-Time Disposal of Obsolete Records (RC-1)- This form is used to request authorization to dispose of or transfer obsolete records series or unsalvageable records that have been destroyed in a disaster. Unlike the continuing authority provided by an RC-2 records schedule, RC-1 one-time disposal application allows records to be disposed of one time and is only applicable to the specific records and dates listed on the application. Templates for all of the forms can be found here.

Permanent Record- Record appraised as having sufficient value to warrant continued, perpetual preservation beyond its period of active use.

Public Office- Any state agency, public institution, political subdivision, or other organized body, office, agency, institution, or entity established by the laws of Ohio for the exercise of any function of government. "Public office" does not include the nonprofit corporation formed under section 187.01 of the Revised Code. See ORC 149.011(A). For additional information see the Ohio Attorney General’s Sunshine Laws Manual.

Public Record- Records kept by any public office, including, but not limited to, state, county, city, village, township, and school district units, and records pertaining to the delivery of educational services by an alternative school in this state kept by the nonprofit or for-profit entity operating the alternative school pursuant to section 3313.533 of the Revised Code. See ORC 149.43(A)(1). For additional information see the Ohio Attorney General’s Sunshine Laws Manual.

Record- Any document, device, or item, regardless of physical form or characteristic, including an electronic record, created or received by or coming under the jurisdiction of any public office of the state or its political subdivisions, which serves to document the organization, functions, policies, decisions, procedures, operations, or other activities of the office. See ORC 149.011(G) for legal definition. See the "Is it a Record" Decision Tree or ask your legal counsel if you have questions about if a document is a record.

Record Series- A group of records arranged together because they relate to a particular subject or function, result for the same activity, document a specific type of transaction, exist in the same media format, or have some another type of relationship.

Record Value- The value of a record encompasses its value for current business, i.e. its administrative, fiscal, legal/accountability value, as well as its historical value.

Recordkeeping Requirements- Statements in statutes, regulations, or government directives that provide general and specific guidance on particular records to be created and maintained by a local government.

Records Commission- Provides rules for retention and disposal of records and ensures that proper procedures are followed for scheduling and disposing of records. Revises and reviews retention schedules and disposal requests submitted for the local government represented. Local records commissions are mandated and governed by Ohio Revised Code sections: 149.38 (counties), 149.39 (municipal corporations), 149.41 (school districts), 149.42 (townships), 149.411 (public libraries) and 149.412 (Special Taxing Districts). For additional information on members and meeting frequency see the Local Records Commissions handout.

Records Management- The planning, controlling, directing, organizing, training, promoting, and other managerial activities related to the creation, maintenance and use, and disposition of records, carried out in such a way as to achieve adequate and proper documentation of policies and transactions and effective and economical management of government operations.

Records Retention Schedule (RC-2)- The RC-2 form is used to set up the records retention schedule. The schedule is used to request continuing authority to dispose of records after the end of the approved record retention period. Each records series must be listed separately, given a unique schedule number, and assigned a retention period. Use the suggested retention periods or one based upon the administrative, fiscal, or legal value of the records to your municipality. Once an RC-2 form has been properly approved it is in effect and should be followed. Templates for all of the forms can be found here.

Retention (Retention Period) - The length of time a record must be kept because it is needed for ongoing business, to document an action, or for statutory reasons. The retention is recorded on Records Retention Schedule (RC-2).

Rule 26- See Supreme Court Rules of Superintendence (Rules 26)

Special Taxing District- Separate division of government that does not fit under the other forms of government. It is a public office as defined in section 149.011 of the Revised Code and that is not specifically designated in section 149.38 (counties), 149.39 (municipal corporations), 149.41 (school districts), 149.42, (townships), or 149.411 (public libraries) of the Revised Code. The term can be found described in ORC 149.412 and this 2013 determination by the Ohio Attorney General.

Temporary Record- Record approved for disposal after a specified retention period.

Transfer- The process of moving records from one location to another. This could include from office space to off-site space or from one department to another. In use with RC-1 and RC-3, transfer refers to moving custody of records from the local government to Ohio History Connection, Ohio Network of American Research Center, or local historical society or library with a written agreement.

Transient Records- Records that are created or received as routine business is conducted, as we prepare other records that will take their place, and as reference. They do not set policy or official guidance.

State Archives- The Ohio Revised Code establishes that Ohio History Connection shall function as the state archives for Ohio to preserve government archives, documents, and records of historical value that may come into its possession from public or private sources. The State Archives reviews RC forms to ensure that records of historical value are being preserved. See ORC 149.31 for additional information.

Supreme Court Rules of Superintendence (Rules 26)- These rules of superintendence concern court records management and retention. Rule 26 (E)(2) requires that a Rules of Superintendence for the Courts of Ohio.

Unauthorized Disposal- The improper disposal of records without approved Records Retention Schedule (RC-2), or the willful or accidental destruction of records without regard to the approved RC-2.

Unscheduled Records- Records whose final disposition has not been established on an approved Records Retention Schedule (RC-2). Unscheduled records may not be destroyed or deleted without adding them to the RC-2.

Frequently Asked Questions

I was just put in charge of scheduling and disposition. Where do I start?

First of all, do you have an approved retention schedule? If not, inventorying your records, and identifying what records your office, department, or government creates, will be your first step.

These steps provide a simple and efficient method for managing government records.

- Organize your Records Commission

- Designate a Records Officer in Each Department

- Conduct a Complete Records Inventory

- Determine a Retention Period for Records Created by Each Department

- Prepare Retention Schedules and Disposal Lists (Forms RC-1, RC-2, and RC-3)

- Submit Schedules or Applications to Records Commission

- Submit Schedules or Applications to the State Archives

- Prepare a Certificate of Records Disposal

- Dispose of Records in Accordance with Approved Schedules or Applications

- Records Commission Should Maintain a Central File

What is a record?

Section 149.011 of the Ohio Revised Code defines a record as a) any document stored on a fixed medium (paper, computer, film, audio/video, etc.) that is b) created, received or sent under jurisdiction of a public office, and c) serves to document the organization, functions, policies, decisions, procedures, operations, and other activities of the office. See the "Is it a Record" Decision Tree or ask your legal counsel if you have questions about if a document is a record. If in doubt, don't throw it out.

What are these forms?

Local government records may be destroyed or transferred only in accordance with sections 149.31, 149.351, 149.38 (counties), 149.39 (municipal corporations), 149.41 (school districts), 149.42 (townships), 149.411 (public libraries), and 149.412 (Special Taxing Districts) of the Ohio Revised Code. Such action involves the preparation of either a schedule of records retention and disposition (RC-2) or an application for one-time records disposal (RC-1).

RC-1 forms are used for a One Time Disposal of Obsolete Records that are no longer created or maintained. For example, during the Civil War your government might have issued bounties to soldiers. Since your government is no longer creating these records, there is no need to include them on a retention schedule (RC-2 form). However, if you wish to dispose of these records, it will still need to be documented and the RC-1 form is the appropriate form to use.

RC-2 forms are the Retention Schedules and tell us how long each record series is going to be retained. RC-1 and RC-2 forms are signed off first by the Records Commission, then submitted to the State Archives – once reviewed and signed by the State Archives, they are sent over to the Auditor of State’s office for review and signature.

An RC-3 form is a Certificate of Disposal for records identified on a RC-2 form. These forms do not require the signature of the Records Commission. The certificate of records disposal serves as the official record of the disposition of the records. Compliance to Section 149.31 ORC is required so that improper disposal does not occur.

How do I fill out an RC-1 form?

See the Instructions- RC-1. This form should only be used for obsolete records, meaning records that are not longer created or maintained by a local government, or for unsalvageable records destroyed in a disaster. In the local government entity field use the municipality, county, township, school, library, or special taxing district name (e.g. Perry Township) and the department or unit in the unit field (e.g. Police Department), if applicable. Include a beginning and end-date for the records, as well as a description. Spell out acronyms or explain terms that may not be universally known.

Schedule numbers can be expressed by a year and item numbering scheme for each records series being scheduled, for example, 16-1 and 16-2. Another option is to include a unique abbreviated identifier for each office, for example, Eng. [Engineer] 1, Eng. 2, etc. The numbering schema is your choice.

Make sure that the form is signed by the responsible official in Part A and the records commission chair in Section B, and that you have included contact information.

See the example for additional information.

How do I fill out an RC-2 form?

See the Instructions- RC-2. In the local government entity field use the municipality, county, township, school, library, or special taxing district name (e.g. Perry Township) and the department or unit in the unit field, if applicable (e.g. Police Department). Do not include dates in your record series, unless the intention is to limit the record series to only those dates. Do include media types. Spell out acronyms or explain terms that may not be universally known. Well formulated descriptions help the State Archives to more accurately determine which records series will require a RC-3 form.

Schedule numbers can be expressed by a year and item numbering scheme for each records series being scheduled, for example, 16-1 and 16-2. Another option is to include a unique abbreviated identifier for each office, for example, Eng. [Engineer] 1, Eng. 2, etc. The numbering schema is your choice, and it will be used later on your Certificate of Records Disposal (RC-3).

Make sure that the form is signed by the responsible official in Part A and the records commission chair in Section B, and that you have included contact information.

See the example for additional information.

How do I fill out an RC-3 form?

See the Instructions- RC-3. In the local government entity field use the municipality, county, township, school, library, or special taxing district name (e.g. Perry Township) and the department or unit in the unit field, if applicable (e.g. Police Department). Make sure that the form is signed by the responsible official and that you have included contact information.

The “Authorization of Disposal” columns refer to the RC-2 that is being used for the disposition of the records. In the column for “Date RC-2 was approved” include the date that the records commission signed the RC-2 that you are referring to (e.g. 5/24/2010), not the date that the RC-3 was approved. Also include the record series titles and schedule numbers from your RC-2. Only include a record series on your RC-3 if you plan on destroying or transferring records under it. If it is useful, you should also include any additional description to help with the review process. Don’t be vague with your date range (e.g. various, all) and include both beginning and end-dates. The proposed dates of destruction should be at least fifteen business days from your submission date.

See the example for additional information.

What is a records commission?

Provides rules for retention and disposal of records and ensures that proper procedures are followed for scheduling and disposing of records. Revises and reviews retention schedules and disposal requests submitted for the local government represented. Local records commissions are mandated and governed by Ohio Revised Code sections: 149.38 (counties), 149.39 (municipal corporations), 149.41 (school districts), 149.42 (townships), 149.411 (public libraries) and 149.412 (Special Taxing Districts). For additional information on members and meeting frequency see the Section 121.22 ORC, Ohio’s Public Meetings law. Detailed commission minutes should be kept. Failure to comply with Section 121.22 ORC could lead to revocation of approvals and void the Records Commission actions.

What is a Special Taxing District?

Separate division of government that does not fit under the other forms of government. It is a public office as defined in section 149.011 of the Revised Code and that is not specifically designated in section 149.38 (counties), 149.39 (municipal corporations), 149.41 (school districts), 149.42, (townships), or 149.411 (public libraries) of the Revised Code. The term can be found described in ORC 149.412 and this 2013 determination by the Ohio Attorney General.

What is a record officer?

Each department should designate one person to be its records officer. The records officer will be responsible for all aspects of records retention and disposition within that department and serve as liaison with the records commission. A records officer has to have common sense, a willingness to learn and the ability to make a decision. Designate a person who take responsibility for the job and is familiar with all the duties and activities of the department and the records it creates and maintains.

What is a records inventory?

An inventory of the entire record holdings of all offices and agencies is, ideally, the first step in creating a sound records program. Inventory all the department's records if possible, both physical and electronic. The purpose of the inventory is to locate, identify and describe the records series maintained by each office. A record series is defined as a sequence of records systematically classified and filed or as a group of records created for a specific activity or function. Some examples of records series are vouchers, receipts, minutes, or correspondence files. For each record series, the inventory should include the office of origin, location(s), information content, inclusive dates, quantity/size, frequency of use, and purpose.

Begin the records inventory in office areas, where the records are familiar to staff members. After the inventory of office records, those records in storage areas should be easier to identify. Note location not only by room, but also by storage unit (file cabinet, shelf, or box). A simple sketch of each room, giving the location of records storage units, eases this task. The completed inventory provides a ready guide to the locations of those records that need to be destroyed and those that should be retained, as well as identifying how records are being created and used.

Is a voicemail a record? Is a note? How about drafts?

Voicemails, and handwritten voicemail messages, are generally considered transient or transitory records, meaning that they have short-term use only. Transient records are records that are created or received as routine business is conducted, as we prepare other records that will take their place, and as reference. They do not set policy or official guidance. Voicemails, notes, superseded drafts, and copies should be included your retention schedule as transient records with a retention period of “until no longer of administrative value.”

How do I determine the retention period for records?

When setting retention periods, you should take the four “values” of the records into account:

- Administrative – how long does your office need these records to do your work? Consult the records creator.

- Fiscal – is the record needed for an audit? Consult your fiscal officer or the Auditor of State’s office.

- Legal – does the record document any rights or obligations? Consult your legal counsel.

- Historical – does the records contain important information about people and places? The State Archives reviews your disposition forms for this value as the reviewing agent at the historical society.

Retention periods are determined and expressed in one of three ways:

- In terms of time (e.g., "retain three years" or "retain permanently").

- In terms of an event or action (e.g., "retain until audit report is released by the Auditor of State" or "retain until case closed").

- In terms of both (e.g., "retain six months after State Auditor's audit report is released" or "retain three years after case closed").

- A retention period may be subdivided: "Retain in office five years, then retain in storage area for five more years, then destroy."

Suggested records retention periods can be found under Key Documents on this page. Before using these retention periods, they must first be submitted on an RC-2 form to the Records Commission, State Archives, and State Auditor for signature. You can also see what governments similar to yours are doing by requesting copies of their retention schedules, or asking for assistance on the Ohio Local Government listserv. You can also check model retention schedules from other states through their websites.

How do I list records of various media types on my RC-2?

If you are keeping both paper and electronic records for the same length time, they could be listed together, with both media types listed. If you are keeping different lengths of time, they should be listed on separate lines. Examples are below.

| Sched. No. | Title/Description | Media Type | Retention |

|---|---|---|---|

| 2016-01 | Canceled Checks | Paper/Electronic | 3 years |

This states that you plan on keeping both the paper and the scanned version for 3 years.

| Sched. No. | Title/Description | Media Type | Retention |

|---|---|---|---|

| 2016-01a | Canceled Checks | Paper | Retain until scanned |

| 2016-01b | Canceled Checks | Electronic | 3 years |

This states that once the paper is scanned you will be disposing of the paper and retaining the scanned version for 3 years

Do I have to use the retention periods listed in the manuals?

The LGRP manuals provide only suggested retention periods. Your local records commission may approve other retention periods.

How long should we keep email?

Email itself is the medium, not a record series, and should be retained according to its content. For more information on managing email see the Ohio Electronic Records Committee’s Managing Email Guidelines.

I have a record that isn't covered on my records retention schedule (RC-2), can I just destroy it?

No. Ohio’s records retention law, ORC 149.351, prohibits the unauthorized removal, destruction, mutilation, transfer, damage, or disposal of any record or part of a record, except as provided by law or under the rules adopted by the records commissions (i.e., pursuant to approved records retention schedules). If a record is not on your RC-2, it is considered permanent until it is properly accounted for on an RC-2 Records Retention Schedule form. An RC-1 One-Time Disposal of Obsolete Records form may be used if the records are obsolete, meaning the records are not longer created o maintained by a local government.

How do I update or amend a previous records retention schedule?

The records schedule is meant to be a living document and should reflect how the records are being kept and managed. You can update your schedules as often as needed. To amend or add an item to your records schedule you will need to submit another RC-2 form. It will go through the same signature process. You can either submit the entire RC-2 with all of the records series again, or just the item or items that are being added or changed. It’s whatever works best for you. Some governments find it easier to keep the items together, so they will submit everything each time they have an update. Other governments will just submit the record series they need to have added or updated. We don’t have a policy dictating either way. Eventually if you have a lot of changes over a period of time, it may be best to submit the entire records retention schedule, though, so that you have a comprehensive RC-2.

Where do I send the RC forms?

Local governments can submit their forms one of three ways -

Email: [email protected]

Using our online submission tool: Forms Submissions

Or postal mail:

Ohio History Connection

State Archives - Local Government Records Program

800 E. 17th Ave.

Columbus, Ohio 43211

I'm submitting my form by email, do I also need to mail it?

No, one copy either by email or mail is fine. There is no need to send a second copy in another format. If sent by email we will let you know that the form has been received and logged for review.

I’ve submitted an RC-2 or an RC-1 – how long will the approval process take?

The RC-1 and RC-2 forms go through a 120-day review and authorization process. The Ohio Revised Code (ORC §149.381(B)) gives the State Archives 60 days to review and the Auditor of State’s representative another 60 days to authorize the form. Once the Auditor of the State has finished their review the forms are sent back to the State Archives. The State Archives the returns the reviewed and approved forms back to the local governments once they are received from the Auditor of State's representative.

Will I get my office’s RC-3 returned to me?

Typically no, we will not return RC-3s after we have reviewed them. If you have not heard from us after 15 business days from the receipt of the form, there are no records that we wish to select for enduring historical value. If you would like to receive notice that your RC-3 has been received and reviewed, you can include an email on the form or send a Self-Addressed stamped envelope with the form.

I just received my reviewed RC-3 form. Does that mean that it’s approved? Can I destroy my records?

We try to stay away from the word “approved” because our main task is to see if there is anything that we want to transfer for historical purposes. Essentially you are just giving us notice of what you want to destroy so that we can intervene if there is something that we think should be saved or transferred. We will also contact you if we notice a problem with the form or with a retention period, but ultimately it is the responsibility of the local government to ensure that the retention periods have been met. Your returned RC-3 should indicate that it was reviewed and if anything was selected for transfer.

Do I still need to submit an RC-3? Is an RC-3 required?

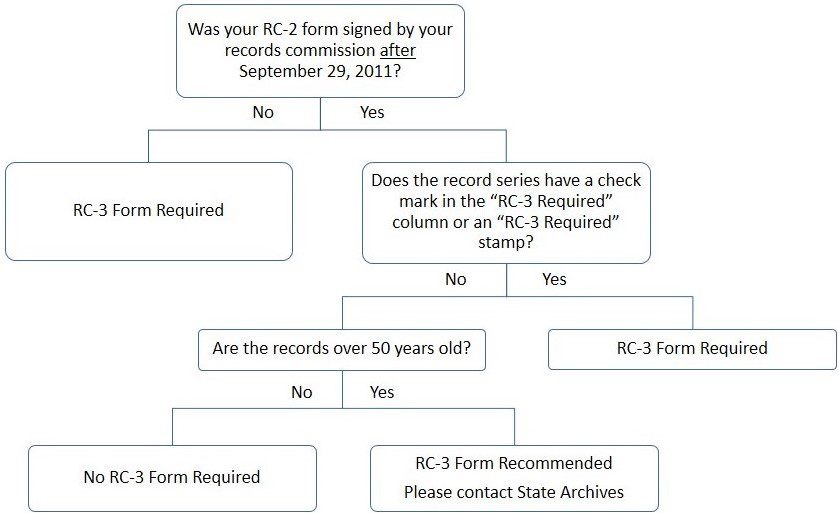

With the passage of House Bill 153 by the 129th General Assembly, if your RC-2 was signed by your local records commission after September 29, 2011, RC-3 forms will only be required for records series indicated by State Archives-LGRP on your RC-2 form. If the record series indicates that an RC-3 is required or if your RC-2 was signed on or before September 29, 2011, an RC-3 is required.

Please contact the State Archives-LGRP if you wish to dispose of a record that is more than 50 years old, even if the RC-2 does not require a RC-3. While the age of a record is not the only factor that determines historical value, in general, records that are 50 years old or older are more likely to have historical value.

With this change we ask local governments to include a brief description for each records series on your RC-2 forms so that we may more accurately determine which records series will require a RC-3 form. We suggest that your local records commission continues to document the disposal of all records series internally.

Why are permanent records marked as "RC-3 Required" on my RC-2?

When we review your RC-2 form we are looking for records with potential historical value. This is why we will still check permanent records. We want to know what is happening with these historical records, such as a format change (ie. paper to microfilm or electronic) or transfer to a historical repository, which should still be documented using an RC-3.

A local historical society is interested in my records – am I allowed to give government records to an institution other than the Ohio History Connection– State Archives?

Absolutely. If a local historical society, university, or other institution is interested in your records, the institution is required to sign a deposit agreement with the State Archives that guarantees that the organization will provide the public unfettered access to the records, and store them properly. The government is required to document the transfer with an RC-1 or RC-3 sent to the State Archives.

Can I scan my records and dispose of the paper records?

Although the Ohio History Connection, which administers the State Archives of Ohio, acknowledges the utility of maintaining digital images for access and retrieval purposes, it does not support the permanent maintenance of records solely in electronic image formats. Technological changes are rapid and constant. With no standards in existence for ensuring the long-term validity and survivability of digital images, it is nearly impossible to predict whether those imaged records will be retrievable in the future. Even well-implemented migration plans cannot assure that data will not be lost. With this in mind, the State Archives strongly recommends maintaining an eye-readable backup of any records deemed of permanent value that have been digitally imaged for electronic storage. However, it is ultimately the decision of the local government and records commission and should be accounted for in the records retention schedule (RC-2). For more information we have a statement on maintaining digitally imaged records permanently. The Ohio Electronic Records Advisory Committee maintains guidelines on document imaging and general electronic records management. They also have a tool to determine the feasibility of scanning.

I have questions about electronic records management and microfilming vendors – can you recommend any?

The Ohio History Connection does not recommend vendors or service providers. In general, governments considering vendors should make sure vendors are tailoring their services to your needs. Many vendors can produce microfilm from digital images and vice versa, allowing you the best of both worlds – access and long-term preservation. Be sure that the vendor has worked with governments similar to yours in size and functions; ask the vendor for names and contact information of other governments they have worked with.

How should I store my records?

In a nutshell: cool, dry and constant. Storing paper records in a cool (65-70 degree) space with low (50-60%) humidity is the best way to slow the deterioration of paper records. The most important thing to maintain is a constant temperature and humidity – even if the ideal temperature isn’t realistic for your facility, constant environment will go a long way towards improving the longevity of your records. Store records in labeled boxes on metal shelves in a room without sunlight, with the lowest shelf at least a few inches off the floor. This arrangement will make it easier to find and access records. If bound volumes won’t fit in boxes, they should be stored flat, without stacking too many on top of one another. Try not to store records on the top shelf to protect them from leaks. Shelving will also make it easier to inventory and locate records or identify which records were destroyed in the case of a disaster. Flooding is the most common cause of damaged records: boxes can protect records from a leaky ceiling, and keeping them off the floor can protect them from standing water, and shelves are easily covered with plastic sheeting until a leak is repaired. Tracking temperature and humidity, and making regular, documented checks for leaks and drafts are basic precautions that can keep small problems from becoming big ones.

Is there a recommended method of destruction once records have met their retention?

There is not a specified form of destruction. If the records are confidential, then shredding is preferred. Recycling may be done with care. Your local government may have a preferred method or a shredding schedule set up. We do not generally recommend burning or tossing records into a dumpster.

My records have been damaged in a disaster (flood, leak, fire, vermin, mold, etc) and it’s not safe or possible to recover them. What do I do?

The Northeast Document Conservation Center (NEDCC) is a nonprofit organization that publishes great resources for dealing with issues like these. Their online preservation leaflets contain step-by-step instructions for records emergency management. The American Institute for Conservation of Historic and Artistic Works has a Field Guide to Emergency Response videos and other resources available to help in your effort.

Your safety and the safety of your staff are paramount. In the event of a disaster, your records commission will need to weigh the possible health concerns and the resources needed to recover the records versus the administrative, legal, fiscal and historical value of the records. If your records commission decides that the records are beyond help, you may destroy them, and document their destruction with an RC-1 or RC-3 form.

How can I prepare for or prevent a disaster that destroys my records?

Unfortunately, many governments don’t think about a records disaster until it happens. It is far easier and far less expensive to prevent a records disaster than to recover from one. This might be a good opportunity for you and the other members of your government to think about a records disaster planning and prevention. The State Archives has compiled some advice and resources. Additional resources can be found through the National Archives and Records Administration, the Society of American Archivists, and the Northeast Document Conservation Center.

How can I build a case with my boss and other stakeholders for better records management?

Materials prepared by the Council of State Archivists’ "Closest to Home" Project are a great place to start. The National Association of Government Archives and Records Administrators created Local Government Records Technical Bulletins that can help you develop talking points. Contact State Archives-LGRP for more information.